MSME/Udyam Registration in Trichy – A Complete Guide for 2025

WHAT IS MSME AND WHY IS IT IMPORTANT?

Micro, Small, and Medium Enterprises (MSMEs) play a vital role in shaping India’s economic growth. They are often described as the backbone of the Indian economy because they generate large-scale employment, promote entrepreneurship, support innovation, and contribute significantly to exports and GDP.

In cities like Trichy, MSMEs form the foundation of local economic activity. From manufacturing units, traders, and service providers to startups, freelancers, and home-based businesses, MSMEs drive balanced regional development and reduce dependency on large corporations. They also act as critical suppliers and service partners for bigger industries.

To strengthen and support this sector, the Government of India introduced Udyam Registration, a simplified and fully digital MSME registration system. This initiative provides legal recognition to eligible businesses and enables them to access government benefits such as easier credit facilities, subsidies, tax benefits, protection against delayed payments, and participation in government tenders.

Registering as an MSME is not just a formality—it is a strategic step toward sustainable growth, financial stability, and long-term credibility.

What is Udyam (MSME) Registration?

Udyam Registration is an online registration process introduced by the Ministry of Micro, Small, and Medium Enterprises under the MSMED Act, 2006. It officially classifies businesses as Micro, Small, or Medium Enterprises based on their investment and turnover.

In July 2020, the government replaced the earlier Udyog Aadhaar system with Udyam Registration to make the process more transparent, data-driven, and automated. The new system is entirely online and based on self-declaration, reducing paperwork and approval delays.

Once registered under Udyam, a business receives a unique Udyam Registration Number (URN) and a digital certificate. This registration allows MSMEs to avail various central and state government schemes, priority sector lending, subsidies, delayed payment protection, and business development opportunities.

Step-by-Step MSME/Udyam Registration Process in Trichy

Step 1: Visit the Official Portal

To begin the MSME registration process, visit udyamregistration.gov.in, the official portal managed by the Government of India. This is the only authorized website for Udyam registration.

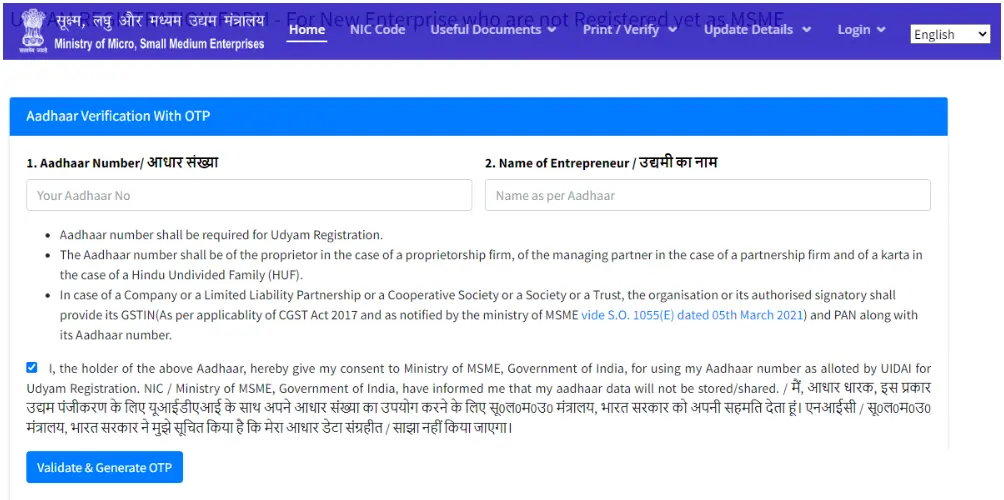

Step 2: Enter Aadhaar Details

Aadhaar authentication is mandatory. The Aadhaar number used depends on the type of business:

- Proprietorship: Aadhaar of the proprietor

- Partnership firm: Aadhaar of the managing partner

- Hindu Undivided Family (HUF): Aadhaar of the Karta

Step 3: Aadhaar Verification

After entering the Aadhaar number and name, an OTP will be sent to the registered mobile number linked with Aadhaar. This OTP must be verified to proceed.

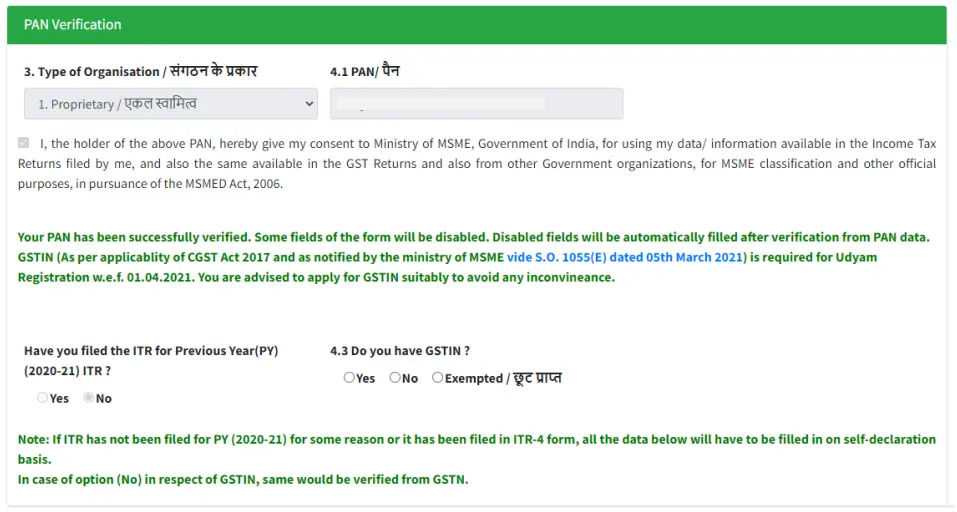

Step 4: PAN Verification

PAN verification is compulsory for all MSMEs. The system automatically fetches income and investment details from government databases. For entities with multiple owners, PAN verification must be completed correctly to avoid rejection.

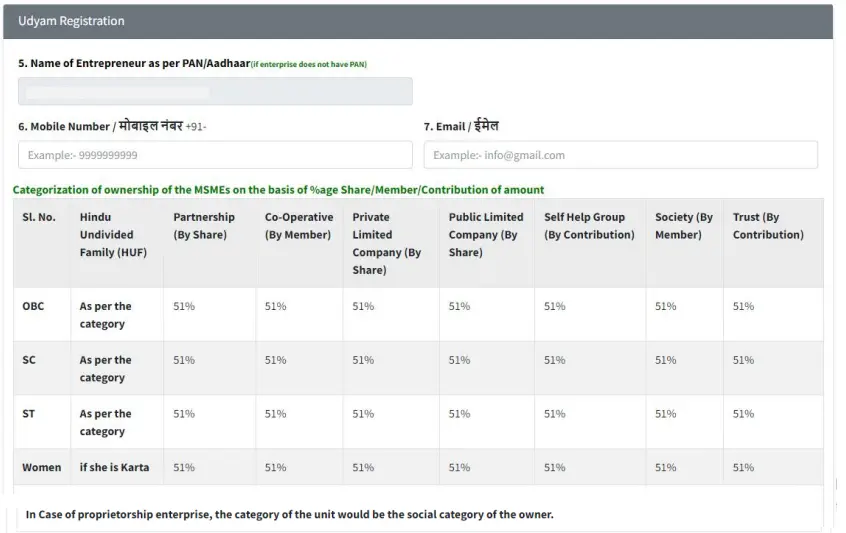

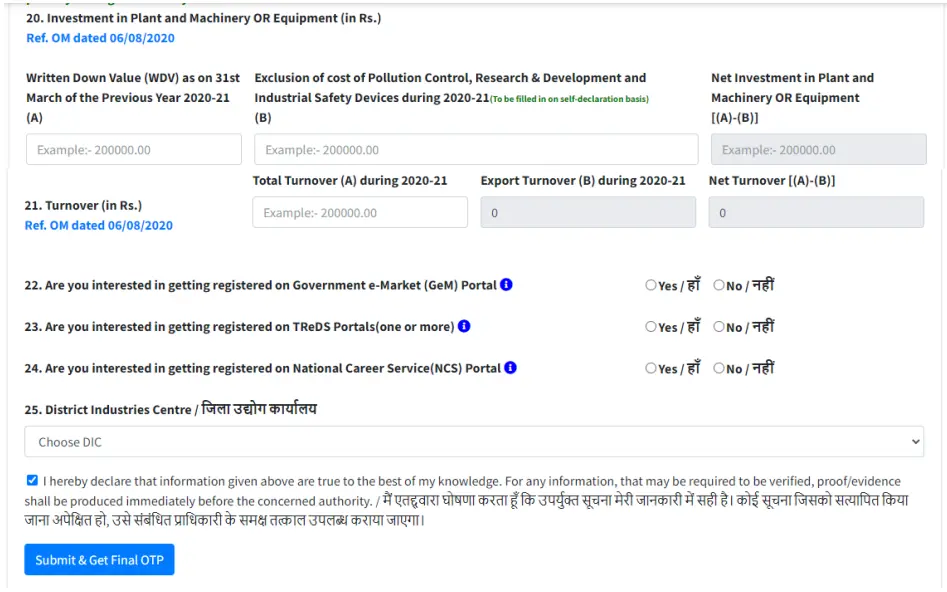

Step 5: Business Information

You must provide accurate business details such as:

- Business name and organization type

- Official business address in Trichy

- Bank account number and IFSC code

- Date of commencement

- Ownership and management details

Step 6: Classification & NIC Code

Select whether your business falls under Manufacturing or Services. Choose the correct NIC (National Industrial Classification) code that best represents your business activity. Enter employee strength, investment, and turnover details.

Step 7: Submit & Receive Certificate

Once the application is submitted successfully, a confirmation message is sent. You will receive your Udyam Registration Certificate with a unique registration number via email.

Eligibility Criteria for MSME Registration

A business qualifies as an MSME based on its investment in plant & machinery/equipment and annual turnover:

| Type of Enterprise | Investment Limit | Annual Turnover Limit |

|---|---|---|

| Micro | ≤ ₹1 crore | ≤ ₹5 crore |

| Small | ≤ ₹10 crore | ≤ ₹50 crore |

| Medium | ≤ ₹50 crore | ≤ ₹250 crore |

Documents Required for MSME Registration in Trichy

Although Udyam registration is based on self-declaration, having the following documents ready ensures accuracy:

- Aadhaar Card – Identification of the applicant

- PAN Card – Business PAN and proprietor’s PAN

- Bank Account Details – Account number and IFSC code

- Business Address Proof – Electricity bill or rental agreement

- Owner’s ID Proof – Passport, driving license, or voter ID

- Owner’s Address Proof – Aadhaar or utility bill

- Passport-sized Photograph – Recent photograph of the owner

Ensuring correct and updated details avoids errors and future compliance issues.

Key Compliance Requirements for MSMEs in Trichy

1. MSME ACT, 2006

Registered MSMEs receive protection under the MSMED Act, including safeguards against delayed payments from buyers. If payment is delayed beyond the agreed period, MSMEs are entitled to interest.

Companies dealing with MSMEs must file MSME Form 1 with the Ministry of Corporate Affairs twice a year, reporting outstanding dues.

2. GST REGISTRATION

GST registration is mandatory for businesses with:

- Annual turnover above ₹40 lakhs (goods)

- Annual turnover above ₹20 lakhs (services)

Even smaller MSMEs may opt for voluntary GST registration to claim input tax credit and enhance credibility.

3. PROFESSIONAL TAX REGISTRATION

Professional Tax registration is mandatory in Tamil Nadu for employers and professionals. It must be renewed annually and is applicable to MSMEs operating in Trichy.

Why MSME Registration is Beneficial for Your Business

- Access to Government Schemes – Priority sector lending, subsidies, and funding support

- Collateral-Free Loans – Easier access to credit from banks and NBFCs

- Market & Tender Benefits – Reservation in public procurement and reduced bid fees

- Legal Support – Protection under the MSME Act from payment delays

- Tax Benefits – Easier tax exemption and return filing process

- Business Credibility – Recognized legal entity improves trust among customers and vendors

Common Mistakes to Avoid

- Using incorrect PAN/Aadhaar details

- Selecting wrong NIC code or business classification

- Not verifying bank or contact details

- Missing compliance deadlines (GST, MCA filings)

- Failing to update business info after major changes

Get MSME Registration Help in Trichy

Need expert assistance? Auditor Shiva offers reliable MSME/Udyam registration support for individuals and companies in Trichy.

- End-to-End

- Documentation

- Fast Online Registration

- Post-Registration

- Compliance

- Affordable Pricing

Call: +91 92446 23455

Visit: auditorshiva.com

Final Thoughts

MSME registration is not mandatory, but it opens doors to a host of benefits that can help small businesses scale and succeed. Whether you’re a startup, a freelancer, or a growing company in Trichy, registering under the Udyam scheme ensures financial inclusion, protection, and growth opportunities.

Ensure your business is registered, compliant, and future-ready by taking advantage of this powerful initiative by the Government of India.

Yes, Udyam Registration replaced the earlier Udyog Aadhaar system in 2020 with a more simplified, fully online and self-declaration-based process.